Welcome to the Crunched Education Program!

Thanks for checking out the Crunched Education Program simulations. Our mission to help prepare students for real life financial tasks and we do that through realistic business experiences, real financial documents and a true small business accounting software. Check out our welcome video below to learn more about the program and how your students can benefit from this supplamental experience.

How the simulations work.

The Crunched Education Program consists of supplemental simulations that provide students with real-world accounting and finance experience. They are designed to help bridge the gap between what students are learning in the classroom and what happens in the real world. The simulations can easily be implemented into an already established curriculum as a midterm, final, or fun class project.

Students will be provided with a simulation workbook that contains real source financial documents. Students will also be given access to our Crunched Cloud Accounting Software where they will input transactions and analyze financial reports. View each component of the simulation below to learn more.

Simulation Workbook

-

Physical hardcopy workbook that acts as the student's guide to the simulation

-

The workbook consists of 10 parts that align with various accounting and finance topics

-

Each part of the workbook will educate and train students on an accounting and finance small task followed by a testing aspect to assess their understanding of the topic

-

Students are met with checkpoints at the end of each part where they will upload their financial reports for instructors to verify accuracy

-

The workbook also contains simulation tips, discussion topics and objectives to assist students and instructors throughout the experience

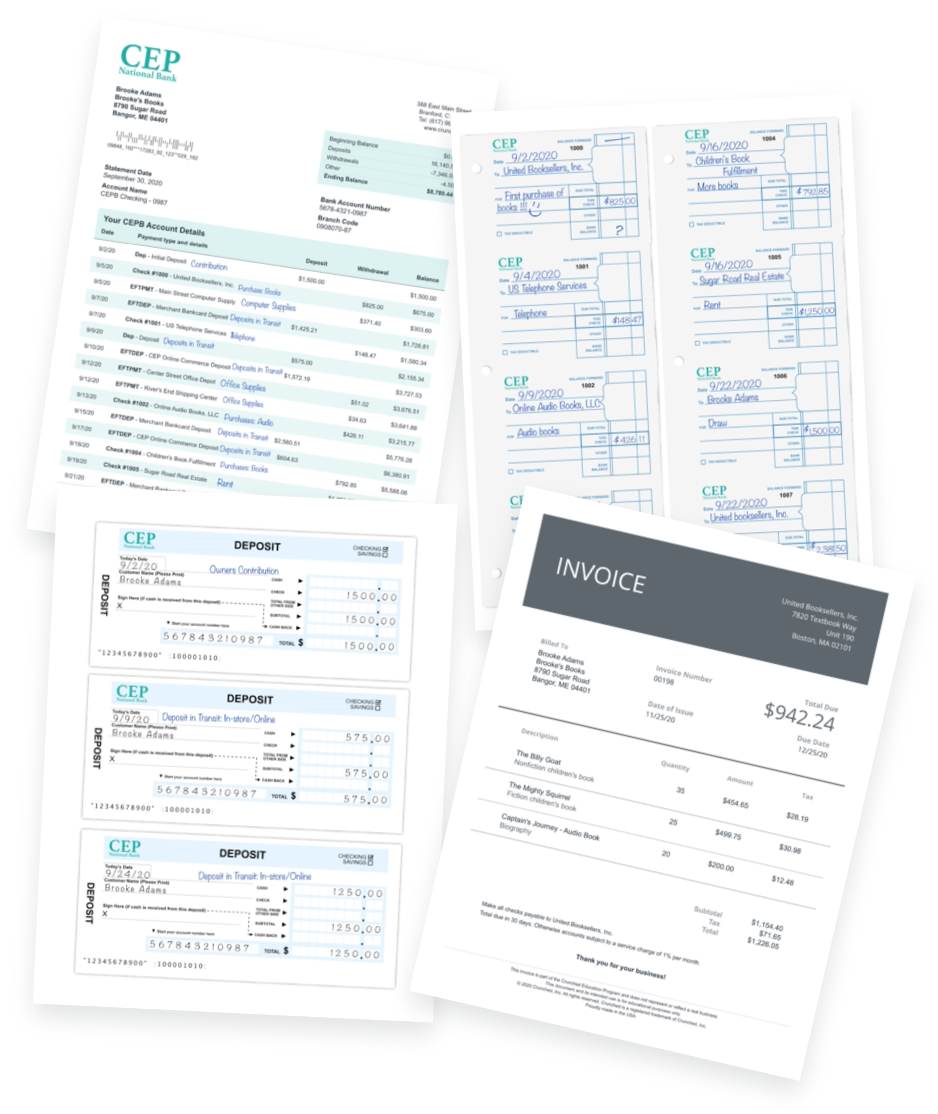

Financial Documents

-

Hard copy, financial documents that are located in the back of each workbook.

-

These financial documents consist of bank statements, check stubs, deposit slips, sales reports, payroll journals, and more.

-

Each simulation contains 3 months of data within the financial documents.

-

Students will analyze the data and learn how to post transactions in the Crunched Cloud Accounting Software.

Crunched Cloud Accounting Software

-

The Crunched Cloud Accounting Software is a web based small business accounting application similar to Quickbooks and Peachtree.

-

The software is 100% cloud based and can be accessed from any computer with internet.

Note: No installation or download is required for software access

-

Each student will receive a unique, randomly generated login credential to access the software.

Note: We do not require or collect student data at any point

-

Students work is automatically saved and can be picked up where they left off on a personal or school computer.

Simulation lesson plans.

Click the parts below to expand with aditional information.

Brooke's Books - Intro to Accounting

Description: Brooke, a sole proprietor, started a book store right out of college and has been growing her business so fast, she is in the process of applying for a line of credit. She needs your students to help get her books in order so she is able to provide the bank with the necessary financial reports. Students will learn to use Brooke's bank statements, check stubs, sales reports, etc. to post transactions in a small business cloud accounting software and analyze financial reports.

Estimated Length: 6-8+ Hours

In this section, students will get familiar with the storyline of the simulation and learn about the journey they are about to face. They will learn the benefits of technology and how accounting has been affected by the various systems that are available. They will utilize their login credentials to access the software portion of the program.

Objectives:

-

Understand the mission of Brooke's Books

-

Learn the benefits of cloud accounting

-

Receive and confirm all program materials

-

Successfully log into your Crunched account

Time: 20-30 Minutes

After students have successfully logged into their Crunched account, they will learn the navigation of a business accounting system. They will explore the various tabs and modules and then learn how to setup and design their chart of accounts and accounts assignments for the AR & AP modules.

Objectives:

-

Become comfortable with navigating an accounting software

-

Understand the common structure of a chart of accounts

-

Know the 5 different account types

-

Assign receivables and payables module accounts

Time: 45-60 Minutes

Students will learn the importance of setting up year-end dates and closing entries. While a closing entry won't occur in this simulation, students will still understand the importance of them and why certain account balances get closed out. Students will also discuss the difference between cash and accrual accounting processes and will learn why Brooke has started the business using the cash method.

Objectives:

-

Understand the importance of setting up year-end dates

-

Understand what a year-end closing entry does

-

Know the difference between the two different accounting methods

Time: 15-30 Minutes

Students will learn how to setup their checkbook within the system and different banking transaction types. They will learn how to enter transactions from data that can be found on Brooke's check stubs, deposit slips, and bank statements. They will complete 3 months of posting, learn to categorize the distribution accounts, and watch how each transaction effects their checkbook balance.

Objectives:

-

Create and assign a checkbook to the appropriate asset account

-

Post checkbook transaction types (Checks, Deposits, EFTs )

-

Maintain appropriate checkbook balances

-

Verify transaction distribution accounts

Time: 75-90 Minutes

After students have entered all bank transactions, they will then learn how to record various sales entries. For this, they will utilize Brooke's in-store and online sales reports, learn how to create a T account from these reports, and ultimately post the sales journal entries. They will learn about debits and credits, sales accounts, sales tax, discounts and returns.

Objectives:

-

Understand debits and credits

-

Posting sales journal entries

-

How to calculate total sales

-

Reviewing sales reports

-

Understanding the use of undeposited/in-transit accounts

Time: 45-60 Minutes

Students will learn about accounts receivable, invoicing and collection terms. They will create customers, sales items, and learn to record and gererate an invoice. Students will then learn how AR transactions affect a cash business and how to review an AR Aging Report.

Objectives:

-

Creating customer profiles

-

Managing sales items and distribution accounts

-

Reading an accounts receivable aging report

Time: 30-45 Minutes

Students will learn about accounts payable, payment terms, and purchase discounts. They will setup vendors and enter payables into the system from real vendor bills while noting the terms, due dates, and the distribution accounts. Students will see how these transactions affect the ledger and they will review the AP aging report.

Objectives:

-

Creating vendor profiles

-

Understand accounts payable and aging reports

-

Reviewing invoice terms, due dates, and purchases

Time: 30-45 Minutes

In this section, students will utilize Brooke's bank statements and learn about reconciliation and outstanding checks. They will learn to clear transactions that have cleared the bank, close monthly rec periods, and see how their bank balance is different then their statement balance. Students will also learn how to review their Trial Balance and report their sales tax.

Objectives:

-

Reconciling and maintaining accurate checkbook balances

-

Understanding of deposits in transit and outstanding checks

-

Tracking and reporting of sales tax liabilities

Time: 30-45 Minutes

Students will now learn the importance of the different financial reports and how to analyze each one. These reports will consist of a Balance Sheet, Income Statement, Trial Balance, General Ledger, etc. They will learn the importance of each report and how their transactions affected each one.

Objectives:

-

Understand the common financial reports

-

Understand the purpose of each

-

Review accuracy of data

Time: 15-30 Minutes

Now that the students have completed all data entry and have reviewed their financial statements, they will provide their final numbers to Brooke. They will pull various numbers from different statements and learn how to create different margin calculations.

Objectives:

-

Gather important data from each report

-

Understand basic margin calculations

Time: 15-30 Minutes

Brooke's Books - Advanced Accounting

Description: Brooke is at it again as she continues to grow her book store. Selling more books than ever, Brooke has recently incorporated, adopted the accural method of accounting, and is required to provide monthly financial reports to her investors. With the change in accounting method, students will gain hands on experience in the areas of inventory and cost of goods sold entries, period end accrual adjustments, depreciation and amortization, and other advanced accounting topics.

Estimated Length: 12-14+ Hours

Lorem ipsum

Objectives:

-

Successfully gain access to your Crunched account

-

Understand the various account types

-

Design a chart of accounts

-

Understand the need for a closing entry

-

Know the difference between a taxable and tax exempt entity

Time: 20-30 Minutes

Lorem ipsum.

Objectives:

-

Create and assign a checkbook to the appropriate asset account

-

Record Brooke's capital investment and fixed asset contribution

-

Setup the inventory asset and beginning/ending inventory accounts

-

Define LIFO & FIFO and determine Brooke's tracking method

Time: 45-60 Minutes

Lorem ipsum

Objectives:

-

Know how to successfully set up vendor profiles

-

Understand the various payment terms

-

Know how to read an accounts payable aging schedule

-

Successfully disburse vendor payments out of the AP module

-

Review checkbook disbursements

Time: 15-30 Minutes

Objectives:

-

Know how to successfully set up customer profiles, sales items

-

Know how to accept a purchase order

-

Successfully create invoices

-

Receive customer payments and apply to open invoices

-

Group customer payments and post a bank deposit

Time: 75-90 Minutes

Lorem ipsum

Objectives:

-

Learn how to read a sales report

-

Create and post journal entries for each sales period

-

Understanding the need for a deposit in transit account

Time: 45-60 Minutes

Lorem ipsum

Objectives:

-

Understand the components of a payroll journal

-

Familiarize yourself with FICA/FUTA/SUTA

-

Review form W-4 and withholding rates

-

Analyze employer and employee taxes

-

Post period journal entries

Time: 30-45 Minutes

Lorem ipsum

Objectives:

-

Understand manual vs automatic bank activity

-

Outstanding checks and their effect on your ending balance

-

How deposits in transit could overstate your checkbook

-

Verify reconciled bank balance with general ledger cash account

Time: 30-45 Minutes

Lorem ipsum

Objectives:

-

Know the benefits of a inventory management system

-

Understand the cost of goods sold calculation

-

Know how to record adjusting inventory journal entries

-

Know how increases and decreases in inventory affect GOGS

Time: 30-45 Minutes

Lorem ipsum

Objectives:

-

Understand why expenses are accrued

-

Know which transactions require timing adjustments

-

Successfully post accrued expense journal entries

-

Successfully post prepaid expense journal entries

Time: 15-30 Minutes

Lorem ipsum

Objectives:

-

Gather important data from each report

-

Calculate important business ratios

Time: 15-30 Minutes

Implementing into your class

Learn more about how the simulations are used in the classroom and the requirements for getting started.

How The Simulations Are Used

-

The simulations are used to give students real-world accounting and finance experience.

-

They can easily be incorporated into an already established curriculum and align directly with the core accounting and personal finance standards.

-

Ranging from 8-14 hours of class time, the simulations are often used as an end-of-year class activity, exam, or capstone project.

-

Account setup is done in house and when materials are received, all there is to do is distribute the workbooks and note on the roster sheet which student receives which login ID. This will give access to student accounts so that you are able to track their progress and assist if needed.

-

No software setup is required for instructors to begin the simulation.

Software Requirements

-

The software is 100% cloud based and can be accessed from any computer with internet.

Note: No installation or download is required for software access

-

The software is supported by all major web browsers such as Chrome, Safari, Firefox, etc.

-

A minimum screen resolution of 1280px is recommended.

-

The Crunched Cloud Accounting Software is not currently compatible with tablets, phones, or touch screen devices.

Student Data & Privacy

-

We do not require or collect any student data at any point.

-

Each student will receive a unique, randomly generated login credential to access the Crunched Cloud Accounting Software.

-

Students will work through fictitious business simulations and no personal data or information is requested or needed.

-

Instructors will be provided with their assigned login credentials and will be able to access their students accounts for tracking and assistance purposes.

Teachers resources

Lorem ipsum

Teacher Edition & Welcome Packet

-

The teacher edition is a physical hardcopy workbook that replicates the student editions and also contains additional notes and answers.

-

The Welcome Packet is included within the teacher materials and contains documents to keep instructors organized. The Welcome Packet contains the following documents:

-

Welcome Letter - Introduction to the program and an overview of each document included in the Welcome Packet.

-

Grading Rubric - If used as a graded assignment, the grading rubric keeps each section organized and indicates how many points each part is worth.

View Sample Grading Rubric -

Class Roster Sheet - A document to note which student receives each software login credential.

View Sample Roster Sheet -

Assignment Collection - Explains how instructors can collect each individual student report and setup assignments in an LMS.

View Sample Assignment Collection Doc -

Final Recap Test - A document that instructors can utilize for a final graded assessment of the simulation.

Online Teacher Portal

-

The Teacher Portal is an online webpage that contains teacher resources, answer keys, support channels & more. It is the central hub for instructors to refer to and utilize before they begin and while they work through the simulations.

-

Answer Keys - The answer keys are compiled of the reports that students will submit after each section of the workbook.

-

Additional Source Documents - If an instructor or student misplaces any of the additional financial documents, they can be downloaded.

-

Live Support Channels - A variety of channels to access instant support if an instructor or student has a question or needs help moving forward.

-

Getting Started Guide - After materials are received, check out the Getting Started Guide for information on how instructors use the program, grading options and more.

-

Live Training - For a better understanding of the program, training sessions are a great way to make sure instructors feel confident and comfortable running through the simulation with their students.

-

Knowledge Base - A compiled list of helpful articles made up of commonly asked questions and suggestions.

Grading the Simulations

Grading each simulation is optional. If the simulation is going to be graded, here are the 2 most efficient ways to do so:

Option 1 - After each part, students will submit their individual report to their instructor. Instructors will utilize the provided answer keys to compare to their student’s reports.

Students will submit the following reports:

Balance Sheet

Income Statement

Trial Balance

General Ledger

Accounts Receivable & Aging Reports

Checkbook Register

Checkbook Reconciliation

Option 2 - At the end of the simulation.

Students will submit their financial recap consisting of various amounts that will be pulled from their completed financial statements. Instructors will utilize their teacher edition and provided answer keys to assess their student’s outcomes.

Pricing and funding options

Lorem ipsum

Plan Types

Annual Plan

Our Annual Plan is where each student will receive their own workbook to write in and keep at the end of the program. With this plan type, you will receive the newest editions with updated numbers and dates each year.

Product ID |

Product Name |

1 Year |

3 Year |

5 Year |

BB1 |

Brooke's Books - Intro to Accounting |

$24.99 |

$22.49 |

$19.99 |

BB1TE |

Brooke's Books - Intro to Accounting |

$24.99 |

$22.49 |

FREE |

BB2 |

Brooke's Books - Advanced Accounting |

$29.99 |

$27.49 |

$24.99 |

BB2TE |

Brooke's Books - Advanced Accounting |

$29.99 |

$27.49 |

FREE |

License Plan

Our License Plan is broken down by simulation workbooks and software access cards. This plan gives you the option to reuse the simulation workbooks like textbooks and only purchase new simulation access cards each year.

Product ID |

Product Name |

1 Year |

3 Year |

5 Year |

BB1 |

Brooke's Books - Intro to Accounting |

$14.99 |

$12.49 |

$9.99 |

BB1TE |

Brooke's Books - Intro to Accounting |

$14.99 |

$12.49 |

FREE |

BB2 |

Brooke's Books - Advanced Accounting |

$19.99 |

$17.49 |

$14.99 |

BB2TE |

Brooke's Books - Advanced Accounting |

$19.99 |

$17.49 |

FREE |

CEPL |

Software Access Card |

$10.00 |

$10.00 |

$10.00 |

Discounts

Multi-Simulation Package Discount

2 Simulation Package

Purchase two of our available simulations for your school and receive a 5% discount on the total order. This discount can be applied on top of other incentives and plan discounts.

Minimum of 5 simulation workbooks per order

3 Simulation Package

Purchase three of our available simulations for your school and receive a 10% discount on the total order. This discount can be applied on top of other incentives and plan discounts.

Minimum of 5 simulation workbooks per order

District Wide Discounts

2-3 Schools

Recieve a 5% district wide discount on the total order if 2-3 schools within your district purchase a simulation.

Minimum of 5 simulation workbooks per school

4+ Schools

Recieve a 10% district wide discount on the total order if 4 or more schools within your district purchase a simulation.

Minimum of 5 simulation workbooks per school

Funding Options

Perkins V Grant

All of our simulations qualify for funding in accordance with section 135 of Perkins V Act. To learn more about the Perkins V Act, check out the Perkins V Website or we recommend working with your school and your district to learn more about the application process.