Brooke's Books

Advanced Accounting

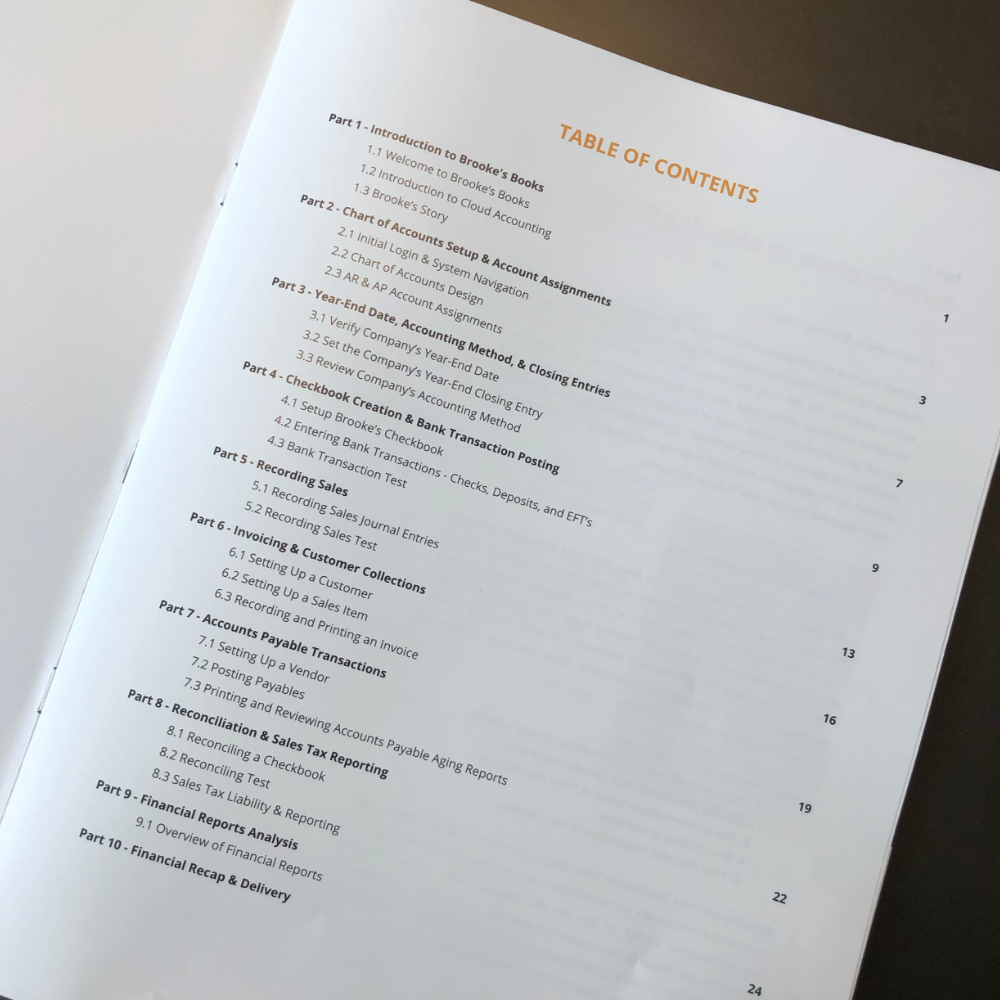

Our Advanced Accounting simulation is designed for those students who want to further their knowledge of advanced accounting topics, gain experiene architecting an effective cloud-based accounting software system, and explore the various aspects of Generally Accepted Accounting Principles, or GAAP.

Topic: Accounting

Level of Difficulty: Intermediate

Estimated Length: 12-14 Hours

Request a demo Talk with sales